Master Investment Analysis

Join our comprehensive program starting September 2025. Learn practical investment strategies, market analysis, and portfolio management from experienced professionals in Canada's financial sector.

Apply for September 2025Our Learning Philosophy

We believe in practical education that connects real market experience with theoretical knowledge. Our approach focuses on building genuine expertise through hands-on learning.

Real Market Focus

Every lesson connects to actual Canadian and global markets. We use current examples from TSX, NASDAQ, and emerging markets to illustrate concepts you'll encounter in your career.

Practical Application

Theory matters, but application drives success. Our students work with real financial data, analyze actual companies, and build portfolios using professional tools used by Canadian investment firms.

Individual Growth

Each student brings different experience and goals. We adapt our teaching to help you develop your analytical skills while respecting your learning pace and career objectives.

"Our mission is to prepare thoughtful analysts who understand that successful investing requires patience, research, and continuous learning. We're not training speculators – we're developing professionals."

Program Structure

Our 16-month program combines foundational knowledge with specialized skills. Classes run evenings and weekends to accommodate working professionals.

Foundation Phase

Months 1-4

Build your understanding of financial markets, economic principles, and investment fundamentals. Learn to read financial statements and understand market mechanics.

- Financial statement analysis

- Market structure and regulation

- Economic indicators and cycles

- Risk assessment basics

Analysis Methods

Months 5-8

Master both fundamental and technical analysis approaches. Learn valuation models, chart patterns, and how to combine different analytical methods effectively.

- Company valuation techniques

- Technical analysis tools

- Industry comparison methods

- Market timing concepts

Portfolio Management

Months 9-12

Learn to construct and manage diversified portfolios. Understand asset allocation, rebalancing strategies, and how to manage risk across different investment types.

- Asset allocation strategies

- Risk management techniques

- Performance measurement

- Rebalancing methods

Professional Practice

Months 13-16

Apply your skills to real-world scenarios. Complete a capstone project analyzing a Canadian company or sector, and prepare for potential career transitions.

- Independent research project

- Professional presentation skills

- Industry networking events

- Career planning sessions

Meet Your Instructors

Our teaching team combines academic knowledge with practical experience from Canadian financial institutions, investment firms, and regulatory bodies.

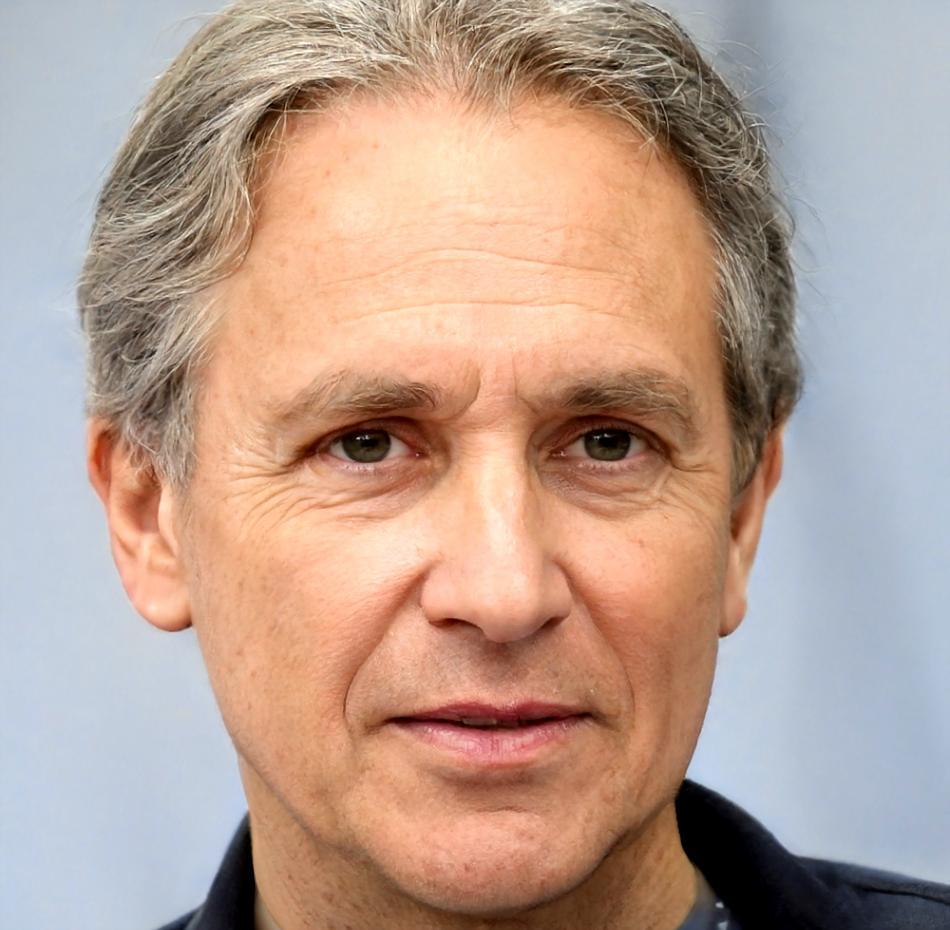

Callum Nordstrom

Senior Investment Analyst

Callum spent twelve years with TD Asset Management before joining our program. He specializes in Canadian equity analysis and has guided portfolios through multiple market cycles. His practical approach helps students understand what really works in portfolio management.

Sienna Kowalski

Former Portfolio Manager

After managing institutional portfolios at RBC Global Asset Management, Sienna brings real-world experience to our risk management curriculum. She's particularly skilled at explaining complex concepts in ways that stick with students long after class ends.

Henrik Dubois

Market Research Director

Henrik leads our technical analysis section and brings fifteen years of experience from Calgary's energy investment sector. He teaches students how to spot opportunities others miss and when market timing actually matters versus when it doesn't.

Investment in Your Future

Choose the learning path that fits your schedule and career goals. All programs include the same comprehensive curriculum and instructor access.

Weekend Intensive

16 months, Saturday sessions

- Full curriculum coverage

- Saturday morning classes

- Online resource access

- Instructor email support

- Networking events

- Digital materials included

Evening Program

16 months, Tuesday & Thursday evenings

- Full curriculum coverage

- Two evening sessions weekly

- Online and offline materials

- Direct instructor messaging

- Professional networking

- Career transition support

- Alumni network access

Accelerated Track

12 months, intensive schedule

- Compressed timeline

- Three sessions per week

- Priority instructor access

- Advanced project work

- Industry mentorship

- Premium resource library

- Job placement assistance

Applications for September 2025 open in March 2025. Class sizes are limited to maintain quality instruction and individual attention. Payment plans available for all programs.